When it comes to beginning a new degree program, one of the first concerns for many prospective students is cost. Although online programs have quickly emerged as a viable alternative for working adults interested in earning a degree, the convenience and flexibility they offer does not necessarily extend to the tuition payments. Many people find that the cost of online classes remains similar to the in-person classes.

Before returning to school, aspiring students need to carefully consider their budget limitations and how they can secure money for their tuition. Fortunately, the number you see on the screen is not necessarily the number you have to pay. There are a wide range of options available for funding your education.

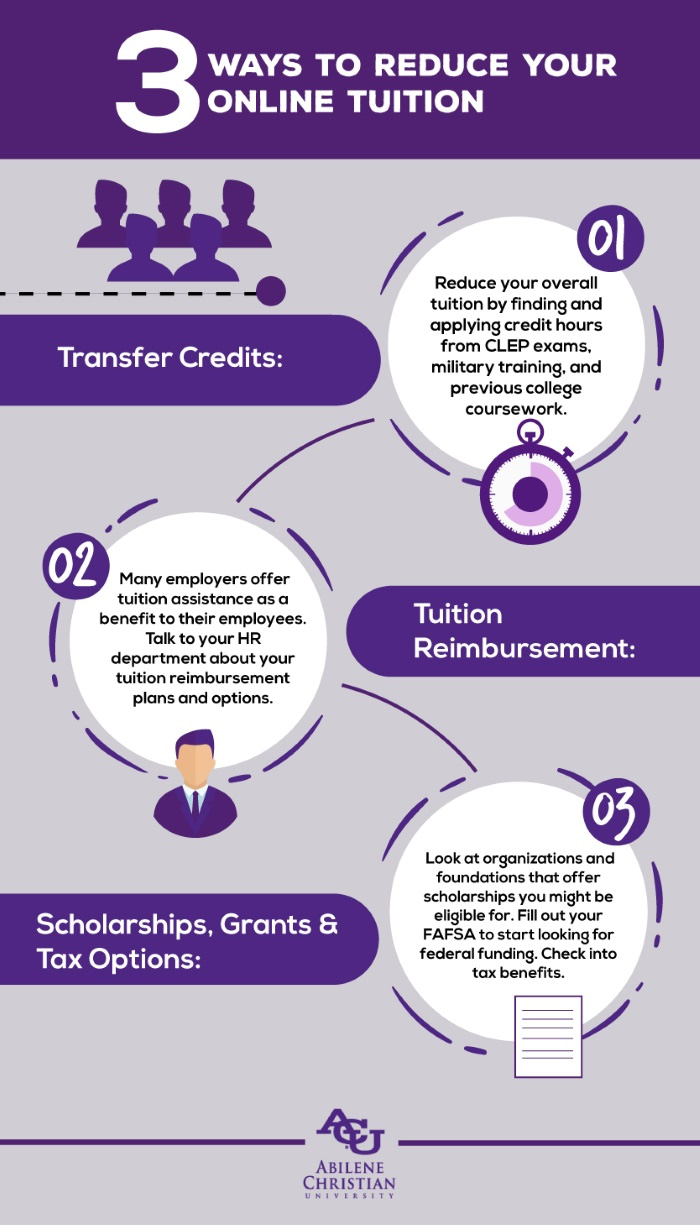

Here are 3 ideas that can drastically reduce the cost of your studies.

1. Look for credit hours you can transfer into your program

Your life experiences—where you’ve been, what you’ve achieved, what you learned—could help you shorten your path to graduation and reduce your overall tuition costs. Check with your school of choice and see if you could attain college credit through:

College, Life and Work Experience

Working professionals returning to school have life and professional experiences that have educated them and helped prepare them for their degree. Often, students might also have prior college coursework from degrees that they began but did not finish. Many programs will allow students to transfer in some of these outside experiences, as well as past courses, as credit hours in particular circumstances. Plan ahead by looking at the online programs you want to consider and see what their requirements are for transferring in credit. The more credit you can count towards your degree, the less time and money you will need to spend to complete it.

CLEP It

Some colleges also allow soon-to-be students to test out on various subjects to see if they can count their prior knowledge as credits. The College-level Examination Program (or CLEP), for example, offers exams in composition and literature, history and social sciences, world languages, science and mathematics, and business. If students pass, they can transfer the tests as credit to the programs that accept them. ACU Online offers CLEP credit for a variety of subjects. These tests do require in-depth knowledge of the topic at hand, but many students appreciate the ability to earn more credits before even beginning their program.

Military Service

Have you served in the armed forces? If the answer is yes, your tuition load could benefit in two ways. First, your military training could be applicable to coursework required by your degree. Check to see if the university you’re interested in attending will evaluate your military experience and training for course credit. Second, you may be eligible for VA benefits or have the option to use your GI Bill benefits. Talk to your school to see how they can help you navigate the process.

Knowing how many credit hours you will be awarded through transfer, CLEP or military service and how many are left to complete your degree will make it easier to calculate how long the degree will take and how much it will cost.

2. Explore employer tuition reimbursement plans

When it comes to degree programs, many employers offer some type of tuition assistance for employees. They want their employees to continue their education, as their new skills could benefit the company. From offering assistance upfront to reimbursing after the grades are in, these tuition assistance programs can be set up in a number of different ways.

Making the grade

Some employers may offer tuition assistance only after seeing the employee’s grades. If this scenario describes the situation at your job, you’ll want to look for a degree program that helps align tuition deadlines with reimbursements. Some programs recognize this employer requirement and offer tuition flexibility plans. This allows students to make payments towards their tuition after they receive these reimbursement checks from their employer.

Payment Plan

Sometimes there just isn’t any middle ground between when the tuition is due and when an employer will offer the reimbursement. If that’s the case for you, many universities will offer students the opportunity to set up payment plans to budget for their tuition costs while waiting for the reimbursement to come through.

This may be an option for you even if you aren’t able to take advantage of an employer reimbursement plan. When making a large up-front lump sum isn’t possible, these payment plans can help you spread out the payments over a more reasonable timeframe. This will make it easier to budget for the costs of your online classes and reduce the struggle to make payments.

3. Look for scholarships and other types of funding

There are multiple places returning students can look for tuition assistance, but starting the process early is crucial. Some applications have deadlines that fall early in the year.

Scholarships and Grants

Students should research scholarships and grants for which they might qualify. The U.S. Department of Labor has a free tool to search for scholarships that can help. You can also speak with the financial aid office at your university for advice and ideas. Ethnicity or heritage organizations, associations related to the field you want to study, and religious institutions are good sources to look into to help defray tuition costs.

Free Application for Federal Student Aid (FAFSA)

Of course, all students should fill out the FAFSA to see if they qualify for help from the federal government. Although this can be a quick and easy way to secure some money for school, sometimes the FAFSA worksheet does not give an accurate picture of your current financial situation. If you do not think it reflects your needs accurately, such as a recent job loss or major medical expenses, you should reach out to the financial aid office at the university. They can help you uncover additional funds you might qualify for when factoring in this subsequent information.

Tax Options

Finally, students should also look for tax options. There may be tax benefits available for people paying for tuition. They can help reduce some of the costs you incur. The deduction that you qualify for will generally be calculated based upon your income and the tuition paid. Speak with an accountant about maximizing your tax benefits while you pay for college tuition.

Although online degrees offer significantly more flexibility than other degree programs, that does not mean that the costs go down. Just like credit hours for an in-person class, students must think carefully about their budget for college classes when enrolling in an online degree program. As you begin to make plans to work toward your degree, consider how you can use some of these strategies to minimize your tuition costs and make earning your degree more affordable.

If you are ready to take the next step toward earning your degree, visit us at www.acu.edu/online. Let’s see how we can help you reach your goals. We look forward to hearing from you.